social security tax limit 2021

The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. How is Social Security taxed 2021.

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

In 2021 the Social Security tax limit is 142800 up from 137700 in 2020.

. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level. 3148 for workers retiring at FRA in 2021 NOTE.

For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security. Social Securitys Old-Age Survivors and Disability Insurance OASDI program limits the amount of earnings subject to taxation for a given year. 2021 Social SecuritySSIMedicare Information Social Security Program Old Age Survivors and Disability Insurance OASDI 2021 Maximum Taxable Earnings.

If they are married filing jointly they should take half. The rule for the year you reach full retirement age also applies when working with the monthly limit. For the 2021 tax year single filers with a.

Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits. For earnings in 2022. For married couples filing jointly you will pay taxes on up to 50.

9 rows This amount is known as the maximum taxable earnings and changes each year. In 2021 the Social Security tax limit is 142800 and in 2022 this amount is 147000. Workers pay a 62.

When you work you earn credits toward Social Security benefits. Married filing separately and lived apart from their spouse for all. For 2021 the first 142800 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad.

The Social Security taxable maximum is 142800 in 2021. Wage Base Limits Only the social security tax has a wage base limit. Higher benefits are possible for those who work or delay benefit receipt after reaching FRA.

Free Federal and low cost State Tax Filing. Essentially you are considered retired unless you make more than the income limit. Maximum monthly Social Security benefit.

Ad Our free federal filing includes life changes and advanced tax situations. The number of credits you need to be eligible for Social Security benefits depends on your age and the type of benefit for which. The wage base limit is the maximum wage thats subject to the tax for that year.

If your combined income is more than 34000 you will pay taxes on up to 85 of your Social Security benefits. If they are single and that total comes to more than 25000 then part of their Social Security benefits may be taxable. Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021.

E-File Directly to the IRS. This is the largest increase in a decade and could mean a higher tax bill for some high earners.

I Ve Got Some Good News And I Ve Got Some Bad News For Those Of You Who Believe The Government Is Efficient Payroll Taxes Capital Gains Tax Funny Vintage Ads

2021 2022 Income Tax Calculator Canada Wowa Ca

Find The Right Way To Plan Your Taxes Forbes Advisor

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

The Top One Percent Net Worth Levels By Age Group Passive Income Investing Spending Problem

I Have Bought A New Computer And Would Like To Copy Turbotax Software For Previous Years From The Old Computer To The New Computer Please Advise Filing Taxes Turbotax Business Expense

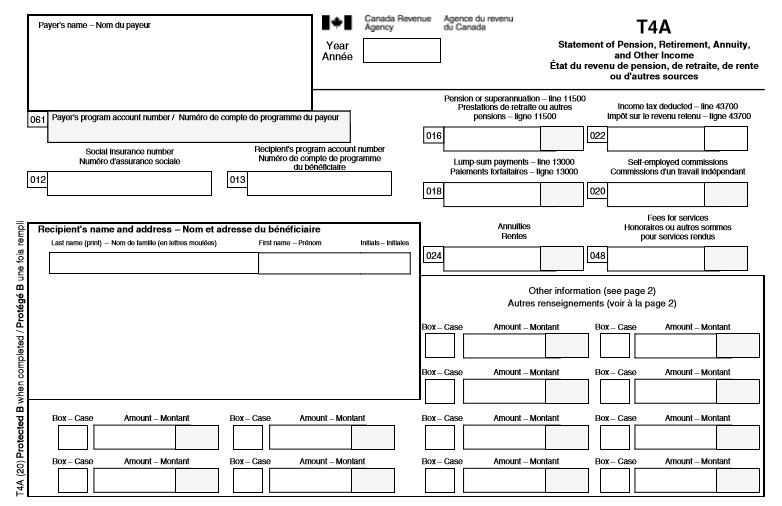

T4a Slip Statement Of Pension Retirement Annuity And Other Income Personal Income Tax Canada Ca

Fridayfire Fairwaynation Thanksgiving Wallpaper Nouwen Wallpaper

Another Tax Headache Ahead Irs Is Changing Paycheck Withholdings And It Ll Be A Doozy Social Security Benefits Income Tax Tax Return

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Have You Ever Wondered How The Tfsa Contribution Limits Work What Investment Options Are Available To You What Money Sense Investing Money Personal Finance

Extension Of Time Limit Secretarial Services Social Security Card Buddy

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Netfile Access Code Nac 2022 Turbotax Canada Tips

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

Blockdata Blockchain Crypto In 2021 A Review In Data Blockchain Data Crypto Market Cap

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)